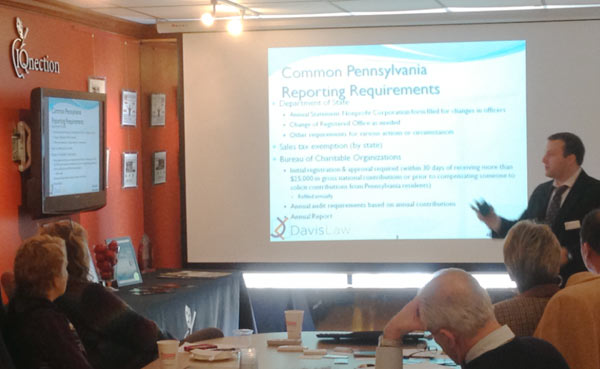

DAVI S LAW’s CEO Marshal H. Davis, Esquire, MBA, LLM was the keynote speaker on January 17, 2013 at the 13th IQnection Nonprofit Summit. His topic was “Forming a non-profit and the steps to 501c3 status“.

S LAW’s CEO Marshal H. Davis, Esquire, MBA, LLM was the keynote speaker on January 17, 2013 at the 13th IQnection Nonprofit Summit. His topic was “Forming a non-profit and the steps to 501c3 status“.

He also discussed how an organization can maintain its tax-exempt status once it is awarded by the IRS. Dr. Davis spoke to various representatives of non-profits, prospective soon-to-be formed non-profits, and individuals and businesses who serve non-profits.

The quarterly IQnection Nonprofit Summits are held in Doylestown, the county seat of Bucks County, Pennsylvania, just blocks from the Bucks County Courthouse, government offices, and many local businesses and nonprofit organizations.

Davis Law advises non-profit corporations and tax-exempt entities of various sizes – from start-ups to long-established community pillars. Davis Law can provide the services to form a non-profit corporation (incorporate), apply for 501(c) status, apply for sales tax exemptions, draft corporate bylaws / constitutions, review contracts, provide board education, and serve as the solicitor / general counsel for your organization to provide a multitude of legal services to help protect your entity and bring it to the next level. Davis Law represents non-profits with a wide array of missions and services.